How to benefit from the Pinel Plus ?

Enhanced scheme offering Pinel Plus tax benefits

to invest while reducing tax

How to benefit from the Pinel Plus ?

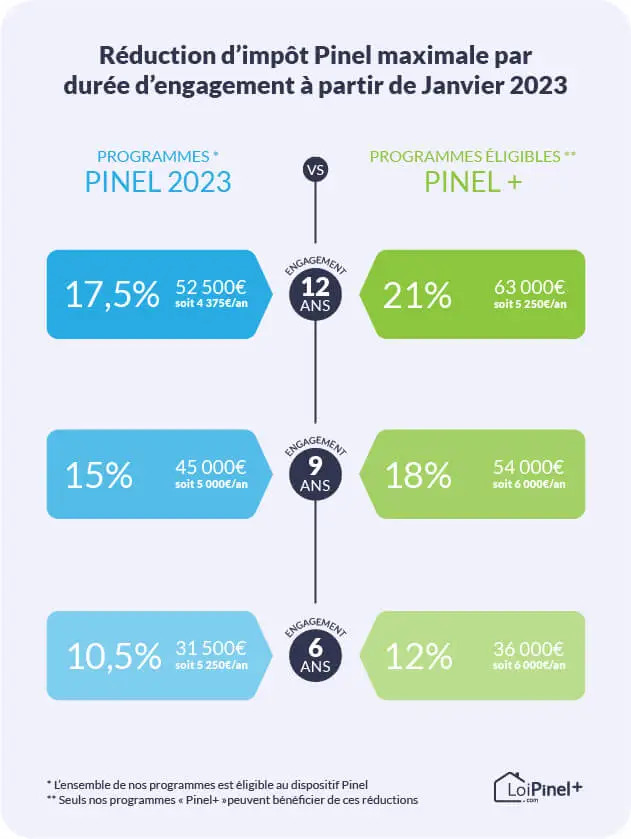

The classic Pinel plan allowed a tax reduction on rental investments when these did not exceed 300 000 € per year and when the property was ready to be rented for at least 6 years. Since 2023, a lot has changed : from now on new requirements linked to energetic performance appear to be mandatory in order to benefit from the highest tax reduction. The classic plan stays available until end 2024 but with less advantages.

What is the difference between the classic Pinel plan and Pinel Plus ?

The answer is simple : the requirements from the new plan involve energetic performance whereas the old one did not.

Conditions for accessing the classic Pinel scheme and benefiting from the tax advantage

In order to benefit from 9 up to 14% of reduction on the income tax in France. One needs to fulfill the following requirements :

- Invest in new housings meant to be rented

- The housing must be part of a collective housing (such as an apartement for instance).

- The housing needs to be located in a "tight area" (where the ask for housing is higher than the bid) : acces the list of tight areas

- The housing shall be rented for at least 6 years (by renting for 9 or even 12 years you can benefit from a higher tax reduction).

- The tenant earns less than 52 991 € / year

- The rent price shall not exceed 26€ per square meter.

Those expectations are not easy to meet. Furthermore the tax reduction will only last until end 2024.

Conditions for accessing Pinel Plus and benefiting from the tax advantage

- Invest in new housings meant to be rented

- The housing must be located in a collective housing

- The housing must be located in a tight area

- The housing shall be rent at least 6 years (once again, by planning 9 or 12 years of rental you will be benefit from even more reduction).

- The housing must be at least 28 m2 and shall include a private outtern space of at least 3 m2 (such as balcony).

- Or be located in a "prioritized district of the city" ( list of prioritized districts)

- Or meet the energetic performance requirements detailed below.

Choosing between Pinel Plus and classic.

At the moment, the Pinel Plus plan should be settled until 2028. Its end has not be forecast yet.

Tax benefits: Get the Pinel Plus tax reduction

If your rented housing is not located in a prioritized district, it will need to meet the energetic performance requirements. The tax reduction can be as high as 21% !

Pinel Plus energetic requirements

Here is the list of energetic requirements :

- Get an A score on the DEP (Diagnostic of Energetic Performance). A B score is permitted if an improvement is forecast.

- Respect the RE2020 standards before January 2025. All details are explained in this RE2020 governmental e-book.

- It is though to provide exact numbers as those vary regarding the housing's location in France. Here is vidéo that clarifies how the RE2020 works..

How to get the RE2020 label ?

To obtain your RE2020 certificate, the easiest way is to call in professionals who will do the calculations for you and prepare your file. There are various companies on the Internet that offer this service for an average of €200 to €400. You can, of course, put together your application yourself using the guide mentioned above. My advice: only apply for the RE2020 label once you have met all the other Pinel Plus criteria. See also: The Pinel + investment scheme

Subscribe to our newsletter

To not miss anything of the real estate news, subscribe to our free newsletter. You will know when new articles, e-books, videos and exclusive offers are released.