Steps to buying a property

Buying a property in France involves a number of specific stages, each of which constitutes a step in the secure purchase of a property. French residents and international buyers alike need to understand each stage of the buying process, from the initial project to the final deed of sale, in order to secure their property investment.

The first step: Clarifying your property plans

This first stage is crucial to the success of your purchase.

In particular, we need to define:

- The type of property you are looking for (flat, villa, main or second home)

- Location (city centre, seafront, residential area)

- The overall budget, including ancillary costs

- The purpose of the purchase: residential, rental or asset investment

👉 This procedure allows you to focus your search effectively and avoid wasting time.

Steps to success for your property project in France

Table of contents

The second stage: Checking your financial capacity and financing

Once the project has been defined, the next step is to securing property financing. This is an essential part of buying a property.

Depending on your situation, there are several options:

purchase cash without recourse to credit,

bank financing in France or abroad,

structuring via a company (SCI, SAS, holding).

It's essential to think ahead:

the amount of notary costs (around 7 to 8 % in older buildings),

any taxes and duties,

maintenance and management costs.

The third step: Finding the ideal property

Looking for a property in France can be a complex process, particularly in tight markets such as Cannes, California, the Croisette or Cap d'Antibes.

Calling on a experienced estate agents like Amanda Properties allows :

access to exclusive goods or off-market,

benefit from objective market analysis,

advice on fair value of the asset.

The visits are then used to validate :

the general condition of the property,

its environment,

its value-added potential.

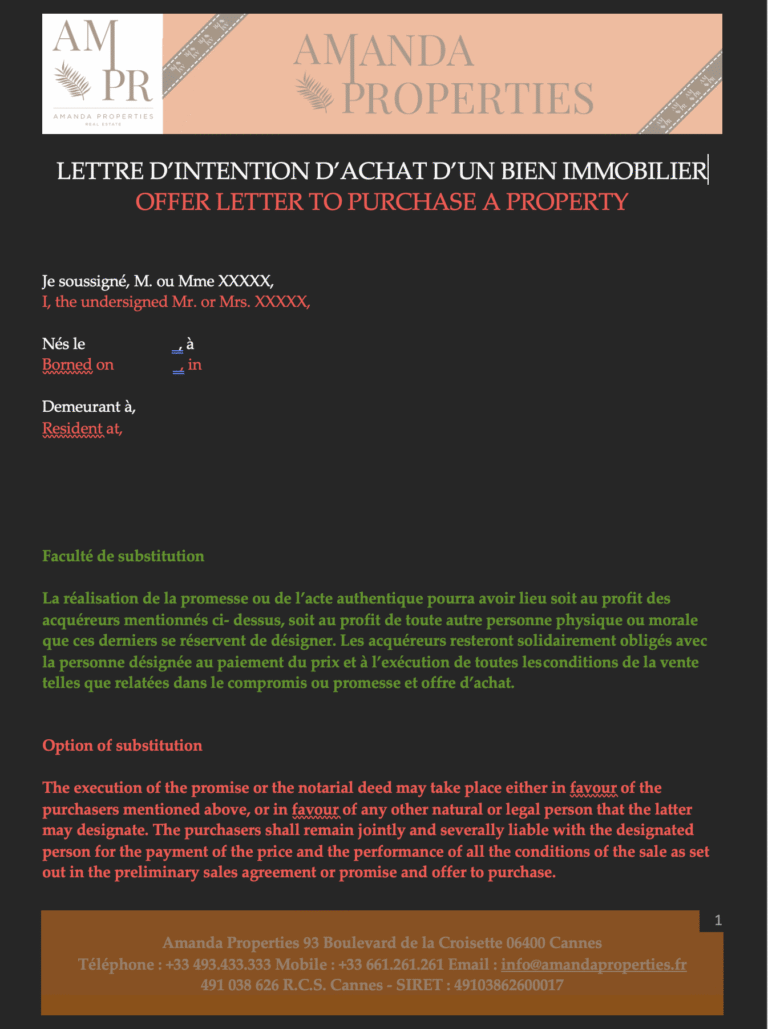

The fourth stage: Formulating an offer to purchase

When the property meets your expectations, the next step in buying a property is to make a written offer to purchase. The offer to purchase is an essential stage in the buying process, as it formalises your intention to buy and initiates negotiations with the seller.

The offer to purchase specifies several points:

the proposed price,

the period of validity and the dates of signature of the promise to sell and the final deed of sale

any conditions (financing, deadlines or special conditions).

If the seller accepts the offer, it becomes the basis for contractual negotiations. The seller can no longer sell to another buyer.

The fifth stage: Signing the promise or preliminary sale agreement

Once the offer has been accepted, a promesse de vente or compromis de vente is drawn up by the notary.

This document is binding on the parties and sets out :

the identity of the vendor and the purchaser,

description of the property,

the selling price,

conditions precedent (obtaining a loan, planning, etc.).

The purchaser generally pays a security deposit (approximately 10 % of the price, which can go up to 5% with the agreement of the parties).

The purchaser benefits from a 10-day cooling-off period, This will allow him to withdraw without penalty.

After this stage, a minimum of two months is needed to finalise the signature. .

The sixth stage: Finalising the purchase at the notary's office: the deed of sale

Once the conditions precedent have been met, the deed of sale is signed at the notary's office.

At this stage :

the balance of the price is paid,

the notary costs are set,

the keys are handed over.

The purchaser officially becomes owner of the property.

The final stage: After the purchase: taxes and obligations

After the purchase, the owner will have to pay certain charges:

the property tax, payable each year by the owner,

the taxe d'habitation, applicable according to the use of the property,

possibly the’Property wealth tax (IFI) according to the asset structure.

Good tax planning can optimise your investment over the long term, so a meeting with a tax expert is always a useful step (Cabinet Marc Philips- Philips & Associates for example: free consultation for the first appointment by recommendation Amanda Properties)...

Contact us

Pourquoi se faire accompagner par Amanda Properties ?

Buying a property in France, and more specifically on the Côte d'Azur, It's all about mastery:

of the local market,

legal and tax aspects,

French notarial practices.

Amanda Properties For over 35 years, we have been serving a demanding French and international clientele, with :

access to rare and exclusive properties,

a made-to-measure support,

recognised expertise in the Cannes market.

📞 Contact us to take you through every stage of your property purchase with confidential, secure and personalised support.

Your questions about buying property in France

What are the steps involved in buying a property in France?

There are several key stages in buying a property in France: defining the project, checking the financing, finding the right property, making an offer to buy, signing a promise to sell or a compromis de vente, and then signing the deed of sale at the notary's office. Each stage is legally regulated to ensure the security of both buyer and seller.

Can a foreigner buy a property in France?

Yes, foreigners are free to buy property in France, There are no nationality restrictions. They enjoy the same rights as French buyers. However, it is advisable to seek professional advice on tax and banking issues.

What are the costs involved in buying a property in France?

In addition to the price of the property, the buyer must provide for :

the notary costs (around 7 to 8 % in older buildings),

any financing costs,

local taxes,

the cost of maintaining the property.

At Amanda Properties, we help our clients anticipate the precise overall budget.

What is a notaire's role in a property purchase?

The notary is a a key player in property transactions in France. He draws up and authenticates the deeds, provides legal security for the sale, checks the location of the property and ensures that ownership is transferred. The notary is neutral and protects the interests of both parties.

What is the difference between a promise to sell and a compromis de vente?

The promise to sell mainly commits the seller, whereas the provisional sale agreement commits both parties. In both cases, the purchaser benefits from a 10-day legal cooling-off period after signature.

Can I withdraw from a preliminary contract?

Yes. French law gives the purchaser a 10-day cooling-off period, without justification or penalty. This period is an essential element of buyer protection.

How long does it take to buy a property in France?

On average, the time between the signing of the preliminary contract and the deed of sale is 2 to 3 months, depending on the presence or absence of conditions precedent (financing, planning, etc.).

What taxes will the owner have to pay after the purchase?

Once the property has been acquired, the owner will mainly have to pay :

of the property tax,

possibly the taxe d'habitation depending on the use of the property,

and, in some cases, the’Property wealth tax (IFI).

Appropriate asset structuring can often optimise taxation.

Why work with an estate agent?

An experienced estate agency can :

access to exclusive or off-market goods,

provide legal and financial security for the transaction,

benefit from local market expertise.

In premium markets like Cannes and the Côte d'Azur, this support is a real asset.

Why choose Amanda Properties to buy a property?

Amanda Properties has been helping French and international clients acquire property in Cannes and on the Côte d'Azur for over 35 years. Our expertise, our network and our tailor-made support guarantee a successful transaction. confidential, secure and optimised.