LMP or LMNP

How to choose between LMP and LMNP to optimise the taxation and profitability of your furnished rental investment. This article will help you choose the most advantageous status for your situation.

Rental investment: LMP or LMNP - Which status is better?

Understanding the difference between LMP and LMNP is essential, because each status has a direct impact on the taxation and profitability of a rental investment.

LMP status entails high levies, so many investors opt for LMNP to benefit from lower taxation.

LMNP is often an effective way of optimising rental income, because it offers substantial deductions and simplified tax management.

Table of contents

What does LMP mean?

LMP means Professional Furnished Rental Company.

It is a tax status applied to landlords who rent out accommodation furnished and fill two compulsory conditions :

- Receive more than €23,000 in furnished rental income per year

- Have rental income that exceeds the other income of the tax household

If these two criteria are met, the owner becomes professional from a tax point of view.

This involves :

From higher social security contributions

A compulsory membership to the social security scheme for the self-employed

Specific rules on depreciation and deductions

What does LMNP mean?

LMNP means Non-professional furnished rental.

This is the tax status most commonly used by owners who rent out furnished accommodation but do not carry out this activity on a professional basis.

To qualify as a LMNP, all you need to do is do not meet the conditions for LMP status, namely :

-

receive more than €23,000 in furnished rental income per year,

and -

have rental income in excess of professional income.

If any of these conditions are not met, you will automatically be granted LMNP status.

LMNP is now considered to be the most attractive status for maximising the profitability of a furnished rental investment.

Why choose LMP or LMNP?

In order to rent with LMNP, you will have to register as a lessor at the official business counter. You can choose between two tax systems ::

- The Micro BIC system : if your rent incomes don't exceed 77 700 € per year.You can benefit from 50% tax reduction which makes accounting easier (30% for seasonal rent in specific areas).

- The Real system you can substract all costs related to your real estate rental (credit interests, property tax, construction bills...). You need to show proof of all these costs.

Which tax system should you choose ?

Costs related to your rental are superior to 38 850 € / year : opt for Real system.

Costs related to your rental inferior to 38 850 € / year : opt for micro BIC system..

LMP or LMNP: Choosing the tax regime for LMNP

In order to rent with LMNP, you will have to register as a lessor at the official business counter. You can choose between two tax systems ::

- The Micro BIC system : if your rent incomes don't exceed 77 700 € per year.You can benefit from 50% tax reduction which makes accounting easier (30% for seasonal rent in specific areas).

- The Real system you can substract all costs related to your real estate rental (credit interests, property tax, construction bills...). You need to show proof of all these costs.

Which tax system should you choose ?

Costs related to your rental are superior to 38 850 € / year : opt for Real system.

Costs related to your rental inferior to 38 850 € / year : opt for micro BIC system..

LMP or LMNP: Which tax regime should you choose if you want to become a non-professional furnished rental operator (LMNP)?

In order to rent with LMNP, you will have to register as a lessor at the official business counter. You can choose between two tax systems ::

- The Micro BIC system : if your rent incomes don't exceed 77 700 € per year.You can benefit from 50% tax reduction which makes accounting easier (30% for seasonal rent in specific areas).

- The Real system you can substract all costs related to your real estate rental (credit interests, property tax, construction bills...). You need to show proof of all these costs.

Which tax system should you choose ?

Costs related to your rental are superior to 38 850 € / year : opt for Real system.

Costs related to your rental inferior to 38 850 € / year : opt for micro BIC system..

With this much reductions, this tax system is way more interesting. It requires a bit more handling because you will have to keep all cost proofs in order to share them when declaring.

How do you deduct for LMNP?

1 Substract your costs

Three scenarios :

- If the amount of money made i superior to your costs than you will have to show proof of all costs when declaring to the URSSAF.

- If the money made is equal to your costs then tax does not apply.

- If the money made is inferior to the costs then you're creating a "property deficit" (loss). This loss can be substracted when you will make profit in the 10 following years !

Example in the third case : you have a 20 000 euros loss on the first year but you make 10 000 euros profit on the second and third year : you can substract the 20 000 loss on and thus avoid tax.

2 Benefit from amortizations

2 Benefit from amortizations

An amortization stand for the loss of value of a good through time.Amortizations never expire. no expiry dateThus you need to use them whenever your rental starts making profit.

What costs are considered amortizations ?

Be aware : some cost types are similar to the ones mentionned before but you can only use them as amortizations or direct substractions. Here's a list :

- 70 up to 90% of the acquisition price of the housing.

- Construction work

- Furniture and equipment

In general, it is preferable to write off major works rather than deducting them immediately, as their costs are particularly high.

Depreciating spreads a major expense over several years, so that the annual burden on your tax bill becomes lighter.

For example, work costing one hundred thousand euros is amortised over fifty years, but the annual deduction is only two thousand.

Write your LMNP declarations

When you declare your property as a LMNP under the real estate regime, you must justify your charges to URSSAF, as mentioned above.

However, this justification must be in the form of an EDI (electronic data interchange) balance sheet, which means a purchase journal and depreciation schedules.

This procedure meets the administrative requirements imposed on furnished tenants.

In addition, you will need to go through a chartered accountant, at an average cost of around €1,000 a year, or produce these documents yourself using accounting software, at an average cost of €300 a year.

What's more, these solutions ensure that your file is compliant while optimising your tax position.

These costs therefore fall within the scope of professional expenses relating to your LMNP business.

In short, these costs are fully deductible, as long as they comply with the accounting requirements of the actual scheme.

Start your LMNP

So you feel ready to launch your LMNP activity with all this knowledge ? Well wait a second and check the following points to avoid any bad surprise :

Verifications

- For seasonal rentals : ask the co-ownership and the town hall if there are specific conditions for your location. Sometimes there can be restrictions.

- See if you qualify for funds the french government could help you finance your project, lear more in our article "invest in real estate at Cannes".

- Register your activity on formalites.entreprises.gouv.fr website in the 15 days after purchasing the housing. You should fill in the purchase date as the date where you started your activity.Otherwise you won't be able to amortize nor substract the housing's purchase.

Material

In order for your housing to be considered as furnitured, you will have to buy the following equipment ::

- Storage (closets or shelves)

- Curtains or shutters for the bedroom's windows

- A bed with blanket and pillow

- Lightning (lamps, spots)

- Hotplates and a oven (or microwave)

- A refrigerator with a freezer part

- Tableware and cooking tools

- A table and some chairs

LMNP rental strategies

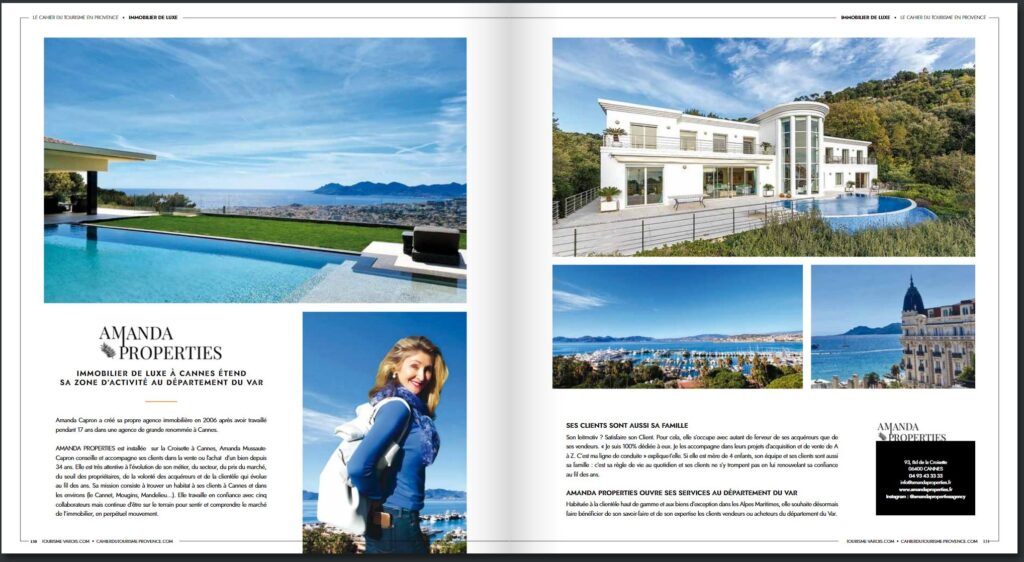

Our real estate agency Amanda Properties offers short-term rentals in Cannes and the surrounding area.

What's more, we'll create and post your advert on over 80 property portals, then select only those tenants with a serious profile, while managing service providers such as cleaning and gardening.

In fact, most of the owners who use our agency opt for seasonal rentals, as the major events on the Côte d'Azur, such as the Film Festival or MIPIM, offer a high demand for rentals.

This makes it possible to generate the equivalent of a long-term rental in just a few weeks, which explains the growing interest in this type of rental.

Benefits when selling

If you decide to resell your housing as an LMNP, you will have to pay 19% tax on the benefits however you can substract all the construction costs a second time ! If you own the housin for more than 5 years, you'll benefit of 6% reduction ( on the total tax amount) and this piles up until 22 years where you will have 0% tax to pay.

Our last advice ? Visit this website https://www.jedeclaremonmeuble.com/ which will help you with administration.

Subscribe to our Newsletter

To not miss anything of the real estate news, subscribe to our free newsletter. You will know when new articles, e-books, videos and exclusive offers are released.